Federal Student Aid Programs

All students applying for campus-based federal and/or state assistance must apply for the Federal Pell Grant by completing the Free Application for Federal Student Aid (FAFSA). This grant is based on financial need according to your Expected Family Contribution (EFC) and the Cost of Attendance (COA). Students may qualify for a maximum Federal Pell Grant award is $7,395 for the 2025–26 award year (July 1, 2025, to June 30, 2026).

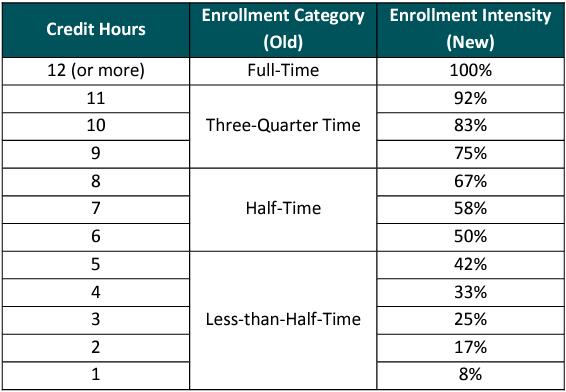

Beginning with the 2024-2025 aid year, the Pell Grant will no longer be based on enrollment status. Instead, Pell Grant disbursement amounts will now be calculated using Enrollment Intensity - which is a percentage value based on the number of credits a student is enrolled for during a term. Per the Act, the Pell Grant must be prorated according to the student’s enrollment intensity rounded to the nearest whole percent. Programs Offered in Standard Terms For federal student aid purposes, full-time enrollment is 12 credit hours.

Note that enrollment intensity cannot exceed 100% for purposes of Pell Grant proration.

Scheduled Pell Award

- An automatic Maximum Pell Grant Award (Max Pell);

- The difference between the Annual Max Pell and the student’s Student Aid Index (SAI); or

- A Minimum Pell Grant Award (Min Pell).

- Subtract the student’s SAI from the Max Pell, then round to the nearest $5 to get the Scheduled Pell Award for that student.

- If the Max Pell minus the SAI calculation results in a Scheduled Pell Award less than the Min Pell amount, the student is ineligible for Pell based on SAI. However, they may still be eligible for Min Pell if they meet the criteria.

- When using fractions, multiply first, then divide.

- If the Scheduled Pell Award exceeds COA, reduce the Scheduled Pell Award to COA (do not round; truncate cents).

Example: $3.697 full-time Pell amount for the term x 58% = $2,144.

The Federal Supplemental Educational Opportunity Grant (FSEOG) is a non-repayable grant for undergraduate students with exceptional financial need, prioritizing Pell Grant recipients, requiring the FAFSA for application, and varying from $100-$4,000 annually based on funds at the participating school, which administers it as campus-based aid, meaning early application is key before school funds run out

- Fill out the FAFSA (Free Application for Federal Student Aid).

- Apply early, as funds are limited and awarded on a first-come, first-served basis.

The Federal Work-Study program provides jobs for students who qualify for financial aid. Students are paid at least the current state minimum wage, but some salaries are higher based on the type of work and the skills required. Awards are made on a first-come, first-served basis until designated funds are exhausted.

For additional information please contact the Career/Transfer Center at (530) 283-0202 ext 313. Please visit the Student Employment webpage for information about the Student Employment Program at Feather River College.

Direct Subsidized Loans

- Available to undergraduate students with demonstrated financial need.

- Award amounts are based on financial need, class level (units completed), and annual federal loan limits.

The U.S. Department of Education pays the interest:

- While you are enrolled at least half-time (6 units or more)

- During your 6-month grace period after you graduate, leave school, or drop below half-time

- During approved deferment periods

- Interest does not accrue during these periods.

Annual Subsidized Loan Limits (may be less depending on need):

- First-year undergraduate: up to $3,500

- Second-year undergraduate: up to $4,500

- Third-year and beyond: up to $5,500

Lifetime Subsidized Loan Limit:

- $23,000

Direct Unsubsidized Loans

- Available to undergraduate and graduate students; financial need is not required.

- Award amounts are based on class level (units completed), dependency status, and annual federal loan limits.

- Interest accrues during all periods, including while you are in school and during grace, deferment, and forbearance periods.

- You are responsible for paying the interest.

- If interest is not paid, it will accrue and be capitalized (added to the principal balance).

Direct Unsubsidized Loan annual limits:

- Dependent undergraduate: up to $2,000

- Independent undergraduate (or dependent students whose parent is denied a Parent PLUS Loan): up to $6,000 per year in the first and second years and up to $7,000 per year in the third year and beyond.

Visit studentaid.gov for more information on Direct Loans.

The Federal Direct Parent PLUS Loan allows parents of dependent undergraduate students to borrow money to help pay for college. The parent is the borrower and is responsible for repayment, not the student. Eligibility requires a credit check, and parents with an adverse credit history may need an endorser or may appeal the decision. These loans can cover up to the student’s total Cost of Attendance minus any other financial aid received.

Federal Direct Parent PLUS Loan — Key Facts

Who Can Apply?

- Parents of dependent undergraduate students may borrow.

- Parents are the borrower, not the student.

- Requires a credit check; parents with adverse credit may need an endorser or appeal.

Loan Amounts

- Parents can borrow up to the student’s Cost of Attendance (COA) minus any other financial aid received (no annual or lifetime limit under current rules before July 1, 2026).

Interest Rate & Fees (2025–2026)

- 8.94% fixed interest rate for loans first disbursed on or after July 1, 2025, through June 30, 2026. This rate is fixed for the life of the loan.

- A 4.228% origination fee is deducted from each disbursement.

- Interest accrues immediately and continues to accrue during deferment or in-school periods.

Repayment

- Repayment generally begins 60 days after the loan is fully disbursed.

- Parents can request in-school deferment while the student is enrolled at least half-time and for 6 months after the student graduates or drops below half-time.

- There is no subsidized interest; interest continues during deferment.

Credit Considerations

-

A credit check is required.

-

If a parent is denied based on credit, they may use an endorser (co‑signer) or appeal the decision.

How to Apply

- Student completes the FAFSA.

- Parent applies for the Parent PLUS Loan at studentaid.gov.

- If approved, the parent signs a Master Promissory Note (MPN).

To obtain more information on PLUS Loans please visit studentaid.gov.

Exit counseling is a vital step in the federal student loan process. Those with loans from the Federal Direct Student Loan program must complete an online exit counseling session on studentaid.gov, Exit counseling is required when you graduate, leave school, or drop below half-time enrollment. Exit counseling provides important information that you need to prepare to repay your federal student loan(s).

- A computer and internet access to studentaid.gov

- FSA ID username and password

- Updated contact information

The purpose of exit counseling is to ensure you understand your student loan obligations and are prepared for repayment. You'll learn about what your federal student loan payments will look like after school and get a recomended repayment strategy that best suits your future plans and goals.

For additional information about federal aid, please visit the Federal Student Aid website. You can also obtain the Federal Student Aid at a Glance Grant and/or Loan Programs.

- Financial Aid - Home

- How to Apply for Financial Aid

- Important Dates

- Types of Financial Aid

- Cost of Attendance

- Unusual Circumstances

- Satisfactory Academic Progress

- Student-Parent Resources

- Financial Aid Workshops

- Financial Wellness

- Financial Aid TV (opens in new window)

- Finish Line Scholars Program

- Plumas Pipeline

- California Virtual Campus (CVC)

- Forms and Policies

- NextUp / Foster Youth

- UndocU

- Veteran Services

- Resources

- Financial Value Transparency and Gainful Employment

- Consumer Information

This site provides information using PDF, visit this link to download the Adobe Acrobat Reader DC software.