Federal Student Aid Programs

Federal Student Aid helps make college education possible for every dedicated mind by providing student financial assistance programs from the government to help you pay for educational expenses at an eligible college or career school. These programs provide grants, loans and work-study funds to eligible students. To apply for this aid you must complete the Free Application for Federal Student Aid (FAFSA) every year.

All students applying for campus-based federal and/or state assistance must apply for the Federal Pell Grant by completing the Free Application for Federal Student Aid (FAFSA). This grant is based on financial need according to your Expected Family Contribution (EFC) and the Cost of Attendance (COA). Students may qualify for a maximum Federal Pell Grant award is $7,395 for the 2025–26 award year (July 1, 2025, to June 30, 2026).

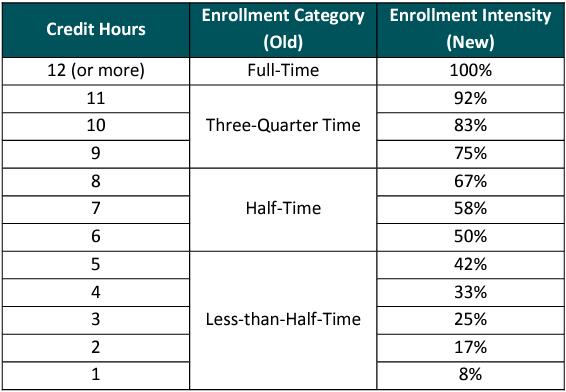

Beginning with the 2024-2025 aid year, the Pell Grant will no longer be based on enrollment status. Instead, Pell Grant disbursement amounts will now be calculated using Enrollment Intensity - which is a percentage value based on the number of credits a student is enrolled for during a term. Per the Act, the Pell Grant must be prorated according to the student’s enrollment intensity rounded to the nearest whole percent. Programs Offered in Standard Terms For federal student aid purposes, full-time enrollment is 12 credit hours.

Note that enrollment intensity cannot exceed 100% for purposes of Pell Grant proration.

Scheduled Pell Award

- An automatic Maximum Pell Grant Award (Max Pell);

- The difference between the Annual Max Pell and the student’s Student Aid Index (SAI); or

- A Minimum Pell Grant Award (Min Pell).

- Subtract the student’s SAI from the Max Pell, then round to the nearest $5 to get the Scheduled Pell Award for that student.

- If the Max Pell minus the SAI calculation results in a Scheduled Pell Award less than the Min Pell amount, the student is ineligible for Pell based on SAI. However, they may still be eligible for Min Pell if they meet the criteria.

- When using fractions, multiply first, then divide.

- If the Scheduled Pell Award exceeds COA, reduce the Scheduled Pell Award to COA (do not round; truncate cents).

Example: $3.697 full-time Pell amount for the term x 58% = $2,144.

The Federal Supplemental Educational Opportunity Grant (FSEOG) is a non-repayable grant for undergraduate students with exceptional financial need, prioritizing Pell Grant recipients, requiring the FAFSA for application, and varying from $100-$4,000 annually based on funds at the participating school, which administers it as campus-based aid, meaning early application is key before school funds run out

- Fill out the FAFSA (Free Application for Federal Student Aid).

- Apply early, as funds are limited and awarded on a first-come, first-served basis.

The Federal Work-Study program provides jobs for students who qualify for financial aid. Students are paid at least the current state minimum wage, but some salaries are higher based on the type of work and the skills required. Awards are made on a first-come, first-served basis until designated funds are exhausted.

For additional information please contact the Career/Transfer Center at (530) 283-0202 ext 313. Please visit the Student Employment webpage for information about the Student Employment Program at Feather River College.

Direct Subsidized Loans

- Available to undergraduate students with demonstrated financial need.

- Award amounts are based on financial need, class level (units completed), and annual federal loan limits.

The U.S. Department of Education pays the interest:

- While you are enrolled at least half-time (6 units or more)

- During your 6-month grace period after you graduate, leave school, or drop below half-time

- During approved deferment periods

- Interest does not accrue during these periods.

Annual Subsidized Loan Limits (may be less depending on need):

- First-year undergraduate: up to $3,500

- Second-year undergraduate: up to $4,500

- Third-year and beyond: up to $5,500

Lifetime Subsidized Loan Limit:

- $23,000

Direct Unsubsidized Loans

- Available to undergraduate and graduate students; financial need is not required.

- Award amounts are based on class level (units completed), dependency status, and annual federal loan limits.

- Interest accrues during all periods, including while you are in school and during grace, deferment, and forbearance periods.

- You are responsible for paying the interest.

- If interest is not paid, it will accrue and be capitalized (added to the principal balance).

Direct Unsubsidized Loan annual limits:

- Dependent undergraduate: up to $2,000

- Independent undergraduate (or dependent students whose parent is denied a Parent PLUS Loan): up to $6,000 per year in the first and second years and up to $7,000 per year in the third year and beyond.

Visit studentaid.gov for more information on Direct Loans.

The Federal Direct Parent PLUS Loan allows parents of dependent undergraduate students to borrow money to help pay for college. The parent is the borrower and is responsible for repayment, not the student. Eligibility requires a credit check, and parents with an adverse credit history may need an endorser or may appeal the decision. These loans can cover up to the student’s total Cost of Attendance minus any other financial aid received.

Federal Direct Parent PLUS Loan — Key Facts

Who Can Apply?

- Parents of dependent undergraduate students may borrow.

- Parents are the borrower, not the student.

- Requires a credit check; parents with adverse credit may need an endorser or appeal.

Loan Amounts

- Parents can borrow up to the student’s Cost of Attendance (COA) minus any other financial aid received (no annual or lifetime limit under current rules before July 1, 2026).

Interest Rate & Fees (2025–2026)

- 8.94% fixed interest rate for loans first disbursed on or after July 1, 2025, through June 30, 2026. This rate is fixed for the life of the loan.

- A 4.228% origination fee is deducted from each disbursement.

- Interest accrues immediately and continues to accrue during deferment or in-school periods.

Repayment

- Repayment generally begins 60 days after the loan is fully disbursed.

- Parents can request in-school deferment while the student is enrolled at least half-time and for 6 months after the student graduates or drops below half-time.

- There is no subsidized interest; interest continues during deferment.

Credit Considerations

-

A credit check is required.

-

If a parent is denied based on credit, they may use an endorser (co‑signer) or appeal the decision.

How to Apply

- Student completes the FAFSA.

- Parent applies for the Parent PLUS Loan at studentaid.gov.

- If approved, the parent signs a Master Promissory Note (MPN).

To obtain more information on PLUS Loans please visit studentaid.gov.

Exit counseling is a vital step in the federal student loan process. Those with loans from the Federal Direct Student Loan program must complete an online exit counseling session on studentaid.gov, Exit counseling is required when you graduate, leave school, or drop below half-time enrollment. Exit counseling provides important information that you need to prepare to repay your federal student loan(s).

- A computer and internet access to studentaid.gov

- FSA ID username and password

- Updated contact information

The purpose of exit counseling is to ensure you understand your student loan obligations and are prepared for repayment. You'll learn about what your federal student loan payments will look like after school and get a recomended repayment strategy that best suits your future plans and goals.

For additional information about federal aid, please visit the Federal Student Aid website. You can also obtain the Federal Student Aid at a Glance Grant and/or Loan Programs.

California State Aid Programs

California State Aid can also help make college education possible for individuals by providing financial assistance to help you pay for educational expenses at an eligible college or career school. These programs include, Cal Grant, Chafee Grant / Education Training Voucher, and the California College Promise Grant.

The California College Promise Grant (CCPG) is available to "waive" the costs of California enrollment fees only. Supported by the California Community Colleges, the CCPG is available to all qualifying students, regardless of how many units they are carrying.

Please visit the California College Promise Grant (CCPG) webpage for complete details.

Cal Grants are California state-funded grants that may be applied toward meeting educational expenses at California colleges. Students must complete and submit the FAFSA or CADAA application by the March 2nd California state deadline to be considered for the grant.

Cal Grant A - Applicable to Eligible Bachelor Program students only. Award amounts vary depending on enrollment. Must be enrolled in at least half-time (6 units).

Cal Grant B - Will be prorated based off of students enrollment. Must be enrolled in at least half-time (6 units) award max up to $1,6484

Cal Grant C - Will be prorated based off of students enrollment. Must be enrolled in at least half-time (6 units) award max up to $1,0945

Cal Grant Recipients with Dependents - This includes what the student is eligible for in Cal Grant A, B, or C and up to an access award of up to $6,000 for qualifying Cal Grant A and B recipients and up to $4,000 for eligible Cal Grant C recipients.

For more information about the three types of Cal Grant, eligibility, renewal and deadlines please visit our Cal Grant webpage.

The Student Success Completion Grant (SSCG) is a California state financial aid program for full-time California Community College students who already receive Cal Grant B or C, offering extra money (up to $4,000/semester, or more for foster youth) to help cover college costs, encouraging them to stay enrolled full-time (12+ units) and finish their degrees faster by meeting Satisfactory Academic Progress (SAP). Eligibility is determined automatically after applying for financial aid (FAFSA/Dream Act), but funding is limited and awarded first-come, first-served, so applying early is key.

For more information about eligibility, award payment and example scenarios please visit our Student Success Completion Grant webpage.

The FRC Promise Scholarship "waives" California enrollment fees for first-time, ful-time eligible California resident students. Our overall goal for the FRC Promise Scholarship is to provide free tuition to all qualifying California resident students. Although, students cannot be eligible for the Federal Pell Grant and/or California College Promise Grant (CCPG) in order to qualify for the FRC Promise Scholarship.

Please visit the FRC Promise Scholarship webpage for complete details.

The California Chafee Grant Program provides funding to current or former foster youth (who have not reached the age of 22 as of July 1st of the award year) to use for career and technical training or college courses. The Chafee Grant Program, also known as the Education and Training Voucher (ETV), is a federally funded program and is subject to the availability of federal funds each year.

For more information about eligibility, requirements and renewal please visit our Chafee Grant webpage.

WebGrants 4 Students

The California Student Aid Commission (CSAC) has created WebGrants 4 Students (WGS) just for you, the student.

WGS will allow you to manage your Cal Grant and/or Chafee account(s) online by letting you view updates, make school changes, make address changes, make corrections, and post leave of absence requests.

It is important for you to understand that your WGS account does not replace your School or FAFSA accounts. Each account must be monitored and managed independently.

Important Note: Students must create a Web Grants account and claim their award. If neither the student nor the school claims their award, the student will not show up on the schools roster to award for the applicable academic year.

Scholarship Programs

Scholarship programs are additional grants that help students continue their college educational goals. Scholarships can bridge the gap between the students cost of attendance and other financial aid offered, limiting out-of-pocket costs. Our FRC Foundation Scholarship applications includes eight different scholarship opportunities for students!

Quick Links:

To find scholarships, start by using scholarship search engines like Fastweb, Scholarships.com, and Niche, which help you find opportunities based on criteria like your major, interests, or location. Check with your school’s financial aid office for merit-based and need-based scholarships, and explore local opportunities through community groups or businesses. Look for scholarships specific to your field, like STEM or athletic scholarships, and stay active on social media for announcements. Always stay organized with deadlines, be cautious of scams, and apply to as many scholarships as possible to increase your chances.

Find and apply for as many scholarships as you can-it's free money for college!

Real Or Scam?

Received an e-mail from someone who will guarantee you a scholarship, but charge you $50? Scholarships will always be free, you should never have to pay. You should never give any personal information unless you are 100% sure you know who you are dealing with. Scholarships are also never 'guaranteed' so stay away from scholarship scams. For more information go to www.FTC.gov/scholarshipscams. By using the internet you can also do a basic search for other scholarship opportunities but remember, DO NOT PAY to apply for a scholarship (this is usually a key indicator of a "scholarship scam").

When tackling scholarship applications, it's essential to stay organized and focused. First, carefully read the eligibility criteria and application instructions to ensure you meet all requirements. Start early to give yourself ample time to gather necessary documents, such as transcripts, recommendation letters, and financial information. Tailor each application to reflect how your goals, achievements, and values align with the scholarship's purpose—don't use a one-size-fits-all approach. Write a compelling personal statement or essay that highlights your unique strengths and experiences. Proofread everything to avoid any errors, and if possible, have someone else review your materials for feedback. Finally, keep track of deadlines and submit your application well in advance to avoid last-minute stress. Being thorough, personal, and timely in your approach can significantly boost your chances of success.

Before you begin, take some time to reflect on your experiences, achievements, and future goals—these will form the foundation of your statement. Write down anything that comes to mind, from academic accomplishments to personal challenges you've overcome. This brainstorming process helps you identify your unique story and the qualities that make you stand out. Once you've gathered your ideas, focus on the prompt and choose the most relevant points to develop. Your essay should highlight not just what you've done, but how those experiences have shaped who you are and why you're a great fit for the scholarship. Be specific, sincere, and showcase your personality. Having someone else review your work can also offer valuable feedback.

Start by choosing recommenders who know you well and can speak to your strengths, achievements, and character—professors, mentors, or employers are often ideal choices. Be sure to ask them well in advance of the deadline, giving them ample time to write a thoughtful and detailed letter. Provide your recommenders with relevant information, such as the scholarship’s purpose, your personal achievements, and specific qualities you’d like them to highlight. This helps them craft a more personalized and compelling letter. Also, be polite and appreciative, acknowledging the time and effort they are putting into supporting your application. Afterward, thank your recommenders, regardless of the outcome, as a sign of respect and gratitude for their help.

- Financial Aid - Home

- How to Apply for Financial Aid

- Important Dates

- Types of Financial Aid

- Cost of Attendance

- Unusual Circumstances

- Satisfactory Academic Progress

- Student-Parent Resources

- Financial Aid Workshops

- Financial Wellness

- Financial Aid TV (opens in new window)

- Finish Line Scholars Program

- Plumas Pipeline

- California Virtual Campus (CVC)

- Forms and Policies

- NextUp / Foster Youth

- UndocU

- Veteran Services

- Resources

- Financial Value Transparency and Gainful Employment

- Consumer Information

This site provides information using PDF, visit this link to download the Adobe Acrobat Reader DC software.